Wondering if spread betting is available all around the world? Well, you’ve come to the right place! In this article, we’ll explore the global reach of spread betting and whether it’s accessible in various countries or not. So, buckle up and let’s dive into the exciting world of spread betting!

Spread betting, the popular form of financial speculation, has gained immense popularity in recent years. But the burning question remains: Does this thrilling investment method transcend geographical boundaries? Can you engage in spread betting regardless of where you live? Let’s find out!

If you’ve ever wondered whether spread betting is a worldwide phenomenon, you’re about to get some answers. We’ll explore the availability of spread betting across different regions, helping you understand if you can get in on the action—no matter where you are. So, let’s embark on this global journey together and discover the world of spread betting!

Is Spread Betting Available Worldwide?

Spread betting is a popular form of trading that allows individuals to speculate on the financial markets. It offers a flexible and leveraged way to take positions on various assets, such as stocks, currencies, and commodities. However, one question that often arises is whether spread betting is available worldwide. In this article, we will explore the availability of spread betting across different countries, the regulations that govern it, and the benefits and considerations for those interested in participating in this form of trading.

The Availability of Spread Betting in Different Countries

Spread betting is not regulated in all countries and is primarily available in certain jurisdictions. It originated in the United Kingdom and is widely popular in countries such as the United Kingdom, Ireland, and Australia. In these countries, spread betting is regulated by respective financial authorities, ensuring that brokers adhere to specific standards and providing protection to traders. In addition to these countries, spread betting is also available in a few other jurisdictions, such as South Africa and Singapore, where it is regulated and offered by licensed brokers.

However, it is important to note that spread betting may not be available in all countries and is restricted or prohibited in certain jurisdictions. Some countries, such as the United States, Canada, and Japan, have specific regulations that do not allow spread betting. It is crucial for individuals interested in spread betting to understand the legal and regulatory framework in their own country before engaging in this form of trading.

Furthermore, even in countries where spread betting is allowed, there may be restrictions on the specific assets that can be traded and the leverage that can be utilized. It is essential to familiarize oneself with the local regulations and seek guidance from reputable brokers or financial advisors before initiating any spread betting activities.

Benefits of Spread Betting

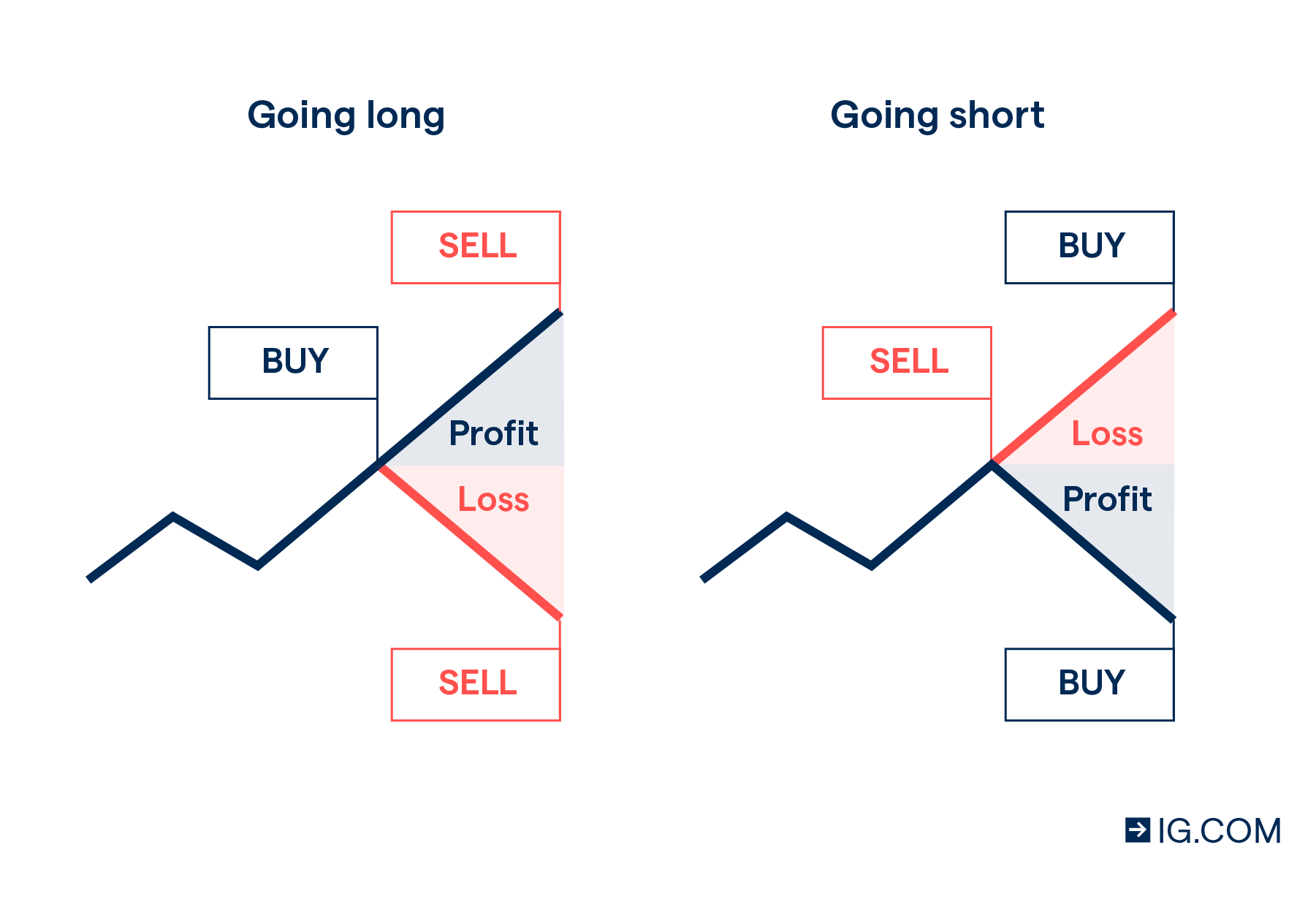

Spread betting offers several advantages for traders, which contribute to its popularity. One of the main benefits is the ability to profit from both rising and falling markets. Unlike traditional forms of investing, where individuals typically make money when the market goes up, spread betting allows investors to speculate on price movements in either direction. This flexibility can be advantageous in volatile markets or during economic downturns.

Another advantage of spread betting is the leverage it provides. Traders can take positions on assets with a relatively small upfront investment, known as margin. This means that spread betting offers the potential for large profits compared to the initial capital outlay. However, it is important to note that leverage also amplifies the risks involved, and traders should carefully manage their positions and use appropriate risk management strategies.

Furthermore, spread betting offers tax advantages in some jurisdictions. In the United Kingdom, for example, profits from spread betting are currently exempt from capital gains tax and stamp duty. This can be appealing for individuals seeking tax-efficient investment opportunities and can potentially enhance overall returns.

Regulatory Considerations for Spread Betting

Before engaging in spread betting, it is crucial to consider the regulatory framework in your country of residence. While spread betting is regulated in certain jurisdictions, this does not guarantee complete protection for traders. It is essential to choose regulated brokers that are authorized and supervised by reputable financial authorities. Verify the credentials of the broker, ensure they have a transparent fee structure, and review customer reviews and ratings to make an informed decision.

Additionally, understanding the risks associated with spread betting is paramount. As mentioned earlier, leverage can amplify both gains and losses. Traders should be aware of the potential for significant losses and ensure they have a solid risk management strategy in place. This may include setting clear stop-loss levels, diversifying their trading portfolio, and avoiding excessive leverage.

In conclusion, spread betting is available in certain countries, primarily in regions such as the United Kingdom, Ireland, and Australia. However, it is important to be aware of local regulations and restrictions, as well as the risks involved. Spread betting offers benefits such as the ability to profit from both rising and falling markets and potential tax advantages. Nevertheless, traders should approach spread betting with caution, conduct thorough research, and develop a comprehensive risk management strategy to ensure a successful and responsible trading experience.

Key Points:

- Spread betting is available in certain jurisdictions, primarily in countries like the United Kingdom, Ireland, and Australia.

- Spread betting may be restricted or prohibited in certain countries, such as the United States, Canada, and Japan.

- It is crucial to understand the local regulations and seek guidance from reputable brokers or financial advisors before engaging in spread betting.

- Spread betting offers benefits such as the ability to profit from rising and falling markets, leverage, and potential tax advantages.

- Traders should carefully manage their positions, understand the risks involved, and develop a comprehensive risk management strategy.

Things to Consider Before Engaging in Spread Betting

Spread betting is a form of trading that offers unique opportunities and benefits. However, before diving into the world of spread betting, there are several important factors that individuals should consider. In this section, we will explore these factors and provide useful tips for those looking to engage in spread betting.

Understanding the Risks Involved

Like any form of trading or investment, spread betting carries inherent risks. The use of leverage can amplify both gains and losses, potentially resulting in significant financial losses. It is crucial for traders to fully understand the risks involved and be prepared to accept and manage potential losses. Developing a solid risk management strategy is essential to safeguard capital and minimize potential losses.

One of the most important aspects of risk management in spread betting is setting clear stop-loss levels. A stop-loss order is a predetermined price at which a trade should be automatically closed if the market moves against the trader’s position. By setting stop-loss levels, traders can limit their potential losses and protect their capital.

Diversifying the trading portfolio is another effective risk management strategy. Instead of putting all the eggs in one basket, traders should spread their bets across multiple assets and markets. This helps to mitigate the risk of one trade significantly impacting the overall portfolio and provides exposure to a wider range of opportunities. Additionally, diversification can help smooth out potential losses and increase the chances of overall profitability.

Choosing the Right Broker

The choice of a reliable and reputable broker is crucial for successful spread betting. When selecting a broker, there are several factors to consider. First and foremost, it is important to ensure that the broker is properly regulated by a recognized financial authority. Regulation provides a certain level of protection for traders and ensures that the broker operates in adherence to established standards and guidelines.

Furthermore, traders should evaluate the broker’s fee structure. Spread betting involves paying spreads, which are the differences between the buying and selling price of an asset. Lower spreads translate into reduced trading costs and can have a significant impact on overall profitability. It is advisable to compare different brokers and choose the one offering competitive spreads and transparent fee structures.

Additionally, traders should consider the trading platform provided by the broker. A user-friendly and intuitive platform can greatly enhance the trading experience and make it easier to execute trades, monitor positions, and access market information and analysis. Demo accounts provided by brokers can be a valuable tool for testing and familiarizing oneself with the platform before committing real funds.

Continuous Learning and Improvement

Spread betting, like any form of trading, requires continuous learning and improvement. Markets are constantly changing, and staying updated with the latest news, trends, and analysis is crucial for making informed trading decisions. Traders should regularly research and educate themselves about the assets they are trading, the factors influencing market movements, and the strategies employed by successful traders.

It can be beneficial to follow reputable financial news outlets, attend webinars and seminars, and read books and articles written by industry experts. Joining online forums or communities can also provide opportunities to interact with other traders, share experiences, and gain insights into trading best practices.

Additionally, traders should consider maintaining a trading journal. A trading journal allows individuals to record their trades, including the reasons for entering or exiting a position, and the outcome of each trade. This practice helps to evaluate the effectiveness of trading strategies, identify patterns and trends, and make necessary adjustments to improve overall trading performance.

Key Points:

- Spread betting involves inherent risks, and traders should fully understand and manage these risks.

- Setting clear stop-loss levels and diversifying the trading portfolio are important risk management strategies.

- Choosing a regulated and reputable broker with competitive spreads and a user-friendly trading platform is crucial.

- Continuous learning and improvement are essential for successful spread betting.

- Staying updated with market news, trends, and analysis, and maintaining a trading journal can contribute to traders’ success.

Key Takeaways: Is Spread Betting Available Worldwide?

- Spread betting is a popular form of trading that allows individuals to speculate on the price movements of financial instruments.

- Spread betting is not available worldwide, as it is regulated differently in different countries.

- Some countries, like the United Kingdom, allow spread betting and have a well-established market for it.

- Other countries, such as the United States, do not allow spread betting and have stricter regulations on speculative trading.

- Before engaging in spread betting, it is important to research and understand the laws and regulations specific to your country.

Frequently Asked Questions

Spread betting is a popular form of trading that allows investors to speculate on the price movements of various financial markets. While it may be widely available in some countries, its availability worldwide can be a subject of curiosity. Here are some common questions about the availability of spread betting globally.

1. Is spread betting legal in every country?

The legality of spread betting varies from country to country. Some countries have explicit regulations and frameworks in place to govern spread betting, while others may have restrictions or even outright bans. It’s important to research and understand the laws and regulations specific to your country or region.

Before engaging in spread betting, it’s essential to consult with a financial advisor or legal professional to ensure compliance with local laws and regulations. Being aware of the legal landscape will help you make informed decisions regarding spread betting activities.

2. Are there any countries where spread betting is widely available?

Yes, there are countries where spread betting is widely available and has a thriving market. The United Kingdom is one such country where spread betting is popular and regulated by the Financial Conduct Authority (FCA). Other countries like Australia, Ireland, and some European nations also have established spread betting markets.

However, availability does not guarantee suitability for every individual. It is crucial to assess your own financial situation, risk tolerance, and trading goals before engaging in spread betting, regardless of its availability in your country.

3. Can I access international spread betting platforms?

Accessing international spread betting platforms depends on various factors, including your residency and the platform’s legal offering in your country. Some spread betting platforms may allow access to traders residing outside their home country, while others may have restrictions.

If you are interested in accessing international spread betting platforms, it’s recommended to do thorough research and consult with a financial advisor to understand the legalities and potential risks involved. Compliance with local regulations should always be a top priority.

4. Are there alternative trading instruments available globally?

Absolutely! While spread betting may not be available in all countries, there are alternative trading instruments that offer similar benefits. Contract for Difference (CFD) trading, for example, is a popular alternative that allows traders to speculate on price movements without physically owning the underlying asset.

Other trading instruments such as options, futures, and forex markets are also available globally and provide opportunities to trade various financial instruments. Exploring these alternatives can expand your trading possibilities beyond spread betting.

5. What are the advantages of spread betting in countries where it is available?

One of the advantages of spread betting in countries where it is available is the flexibility and versatility it offers. Spread betting allows traders to speculate on both rising and falling markets, providing potential opportunities regardless of market direction.

In addition, spread betting often provides tax advantages in certain jurisdictions, making it an appealing trading option for individuals seeking tax-efficient ways to generate profits. However, it’s important to consult with a tax professional to fully understand the tax implications based on your country of residence.

What Is A Spread Bet? – Sports Betting 101 at FanDuel Sportsbook

Summary

Spread betting is a type of financial trading that is not available worldwide. It is mainly offered in countries like the UK, Ireland, and Australia.

If you’re interested in spread betting, it’s important to check the regulations and availability in your country, as it may not be allowed or accessible.